New environmental rules, more complex engines and a seventh year of economic pressure are scrutinising lubricant costs as never before.

Shell Marine Products’ (SMP) new General Manager enters

a conversation he believes would be better focused on cost of ownership

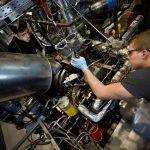

Toschka was appointed on 1 October. He sees Shell’s Marine and Power Innovation Centre (MPIC) in Hamburg as one cornerstone[ds_preview] of the company’s case for industry thought leadership.

In the immediate term, however, much of Toschka’s time is being spent speaking to customers. »The same technical and vessel performance challenges face shipping the world over, but the various regions have their differences so that it is essential in this first phase in the new role that I reach out to customers and staff outside Europe – in China, the Middle East, Singapore and also in the US«, he says.

Environmental restrictions, new engine designs and changing operational factors have required an intense period of innovation in marine lubricants. »We have made full use of our R&D budgets and our investments in dedicated SMP testing facilities«, Toschka says.

Within weeks of taking up post, Toschka was also overseeing the launch of SMP’s new Environmentally Acceptable Lubricants (EALs) range, which includes Shell Naturelle S4 Stern Tube Fluid 100. According to him, these products comply with the revised 2013 US Vessel General Permit (VGP) covering commercial vessels longer than 79 feet operating in US waters. The VGP demands EALs for all applications with a possible oil-to-sea interface unless technically infeasible.

»Shell Naturelle S4 Stern Tube Fluid 100 is made with fully saturated ester base oil, offering the better protection from hydrolysis [breakdown by water] and oxidation [oil ageing],« says Toschka. »Our decision to go for a non-emulsifying product underpins SMP’s reputation for product quality. It allows ship operators to easily drain any water from the stern tube system, preventing hydrolysis and biodegradation of the oil within the equipment.«

Environmental restrictions have also been a main driver in the marine engine market, with their recent impact most telling in the two stroke engine sector. The adoption of slow steaming regimes has also brought new engine maintenance issues, and a need for a direct response from cylinder oil suppliers.

»Today, we are in the seventh year of a shipping economic crisis and the biggest focus is on reducing the fuel consumption, which has resulted in new engine designs over the last few years. Whilst these engines consume less fuel – which is very good from many perspectives – they are more complex and challenging to lubricate when used in slow steaming modus, which has become the ›new normal‹ operating modus for many ships to save more fuel«, says Toschka.

Responding to these conditions would have been difficult enough in a normal environment. In the current shipping crisis, however, it is very stretching for many players. Ship owners are increasingly forced to apply very short term cost focus. »I know that it is easier said than done, but a longer term total cost of ownership perspective would prevent regret value considering the lifetime of the equipment and the vessels«, says the General Manager.

For two stroke engines, SMP now offers the Shell Alexia range designed to combat all four types of oil stress under the widest range of operating conditions, with Shell Alexia S3 being formulated specifically to protect engines operating with low sulphur fuels in ECAs to Shell Alexia S5 and Shell Alexia S6 for newer ship engines. Shell Alexia S3, Shell Alexia S4, Shell Alexia S5 and Shell Alexia S6 cylinder oils, with base numbers ranging from 25BN to 100BN to take account of a range of fuel sulphur contents and vessel operating profiles.

»In the cylinder oil case, we have needed a greater range of products available at more destinations over the last 12 to 18 months. We do not need to have all of the products available in all markets, but we have added a number of ports of product delivery in the last 12 months«, he explains.

»To really add value, we need to respond as a service partner to customer needs. For example, clients are facing an erosion in the knowledge base held by crews. Our technical services support and the training we offer is becoming a critical part of our contribution to the wider marine industry.«

Also forward-looking is Toschka’s view that energy demand might double by 2050, suggesting the need for a mixture of energy resources: »We do believe LNG, for example, will play a role in the future of the marine fuels industry.« His expectation is that gas engines will take a growing share of the two stroke market: »We have the right products for the four stroke sector already for some time and we have just developed lubricants to take care of low sulphur content fuel for two stroke engines as well.«