Kay Dausendschön believes that AIS data can provide tremendous value

for shipping companies with possible huge monetary benefits

AIS (Automatic Identification System) data has been used for many years for more than its intended purpose, i.e. navigational safety[ds_preview]. Commercial applications such as vessel tracking, alert monitoring, trade analysis etc. are widely used nowadays. Basically, such applications only require AIS data, an electronic map and a set of GPS coordinates to identify key areas (ports, quays, emission control areas). Interestingly, most commercial applications are found outside shipping. Part of the reason is that AIS allows »outside-in« views on global shipping, generating valuable insight for all players in the maritime value chain that could otherwise be obtained only from the vessel operating companies themselves.

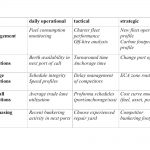

AIS data, especially when combined with other data sources, can provide tremendous value for shipping companies and related industries alike. For the shipping sector, AIS data mining may become a fundamental game changer. Linking up AIS data with technical vessel information, consumption models, weather and sea state data, geographical information (e. g. regions, ports, berth and anchorage areas), sailing schedules and other sources builds the basis for advanced analytics and insight that can support decision making at operational, tactical or strategic level. One may argue that shipping companies have information about their vessels already at their fingertips, even without AIS. However, retrieving such information from reports and systems is tedious, even more combining it with other types of data. More importantly, when using only own company data, benchmarking against the competitors is not possible.

Typical issues that may be addressed through integrated AIS analytics and post-processing include tracking how partners and competitors run their networks and manage their port operations. The data show which ports/terminals have congestion issues, whether a targeted berth will be available on time, how partners and competitors adopt slow steaming and constant speed profile – and how this may affect their fuel bills. AIS data can also provide information on other operators’ schedule integrity, bunkering footprint/efficiency, dry-dock operations, and time spent in port and at anchorage – and the impact this may have on average speeds. Two examples illustrate these applications in more detail.

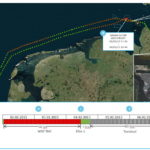

Delay Management

In container shipping, delays are often the rule rather than the exception. They can become costly as berths become unavailable, speeding up burns more fuel, cargo from skipped ports needs to be repositioned, etc. An operations department manager would benefit from a review of where his services ran out of schedule (root cause analysis) and what mitigation actions were taken (speed up, skip port, cut and run, etc.). So he can discuss mitigating costs with the sales department that is interested in keeping the ship to its original port call schedule to avoid customer complaints. By combining schedule data with vessel port call/anchorage time data, it is possible to pinpoint where operations went wrong and with speed data it can be seen where vessels sped up to catch up again.

Voyage management

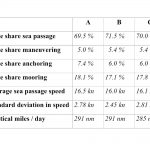

AIS data can be used to analyse own and competitors’ performance regarding voyage management. For example, AIS gives speed information with much higher data density than noon reports. This can be used to derive various key indicators:

Speed variability during deep-sea passage – Too high starting speed, slowing down later on to match arrival time in port indicates poor voyage planning. Speed variations around a constant mean may be due to weather.

Average sea passage speed – Too high pro-forma speed may indicate poor pro-forma scheduling.

Operating profile standard deviation (head-haul/back-haul)

Port times – Long port stays may indicate poor port productivity or poor coordination with terminal operator.

Anchorage times – Anchorage times due to early arrival may indicate poor voyage planning.

Nautical miles/day

In a test, irregular speed patterns resulted for one client in ~2mill. $ higher fuel bill per year for an 8,500TEU containership. There are many more potential applications for AIS-based business intelligence, but these examples may suffice to realize the scope and power of this new technology. AIS information will fundamentally change the transparency in the shipping market and early adopters will hugely benefit from this effect.

Kay Dausendschön