The multipurpose shipping market (MPP) wil[ds_preview]l see the first signs of recovery by the end of 2017, following in the steps of the dry bulk and container shipping markets, according to Drewry.

Dry cargo demand is weak but strengthening with MPP shipping market share expected to grow at just under 2% per year to 2020. Demolition levels are up in both the multipurpose and competing sectors, whilst newbuilding ordering has waned, which will result in minimal aggregate multipurpose fleet growth to 2020.

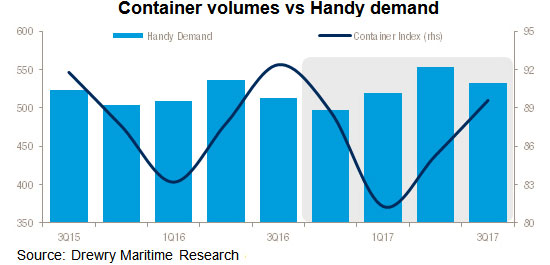

The future market prospects for the MPP shipping sector are not only dependent on the supply-demand balance for that segment, but also on the other vessels that compete for breakbulk and project cargo, in particular Handy bulk carriers and container vessels.

The future market prospects for the MPP shipping sector are not only dependent on the supply-demand balance for that segment, but also on the other vessels that compete for breakbulk and project cargo, in particular Handy bulk carriers and container vessels.

»Slow growth in supply, alongside better growth in demand, is expected to help multipurpose charter rates in 2017 and beyond, supported by a recovery in the dry bulk market, albeit a slow one,« comments Susan Oatway, lead analyst at Drewry.

Only a small effect on demolition

The new International Maritime Organisation (IMO) regulation on Ballast Water Management is likely to have a small effect on demolition levels in the multipurpose sector, and even more so for the bulk carrier sector.

At the same time any investment in this sector will be in project carriers (with a lift of 100 tonnes or more) producing fleet growth in this segment of almost 3% pa to 2020, whilst the general cargo segment will contract at around 2% pa over the same period, leading to overall MPP fleet growth of less than 1% pa to 2020.

»The competition for cargoes from bulk carriers and containerships will keep rates subdued for at least another 12 months. Until rate increases are sustained in the bulk carrier and container ship sectors, there will be little reprieve in their drive to obtain further market share,« added Oatway.