SBM Offshore reports a jump in 2016 EBITDA[ds_preview] as revenues decrease, concluding. The company expects revenue to decline also in 2017, but sees early signs of market stabilization but with a slow recovery.

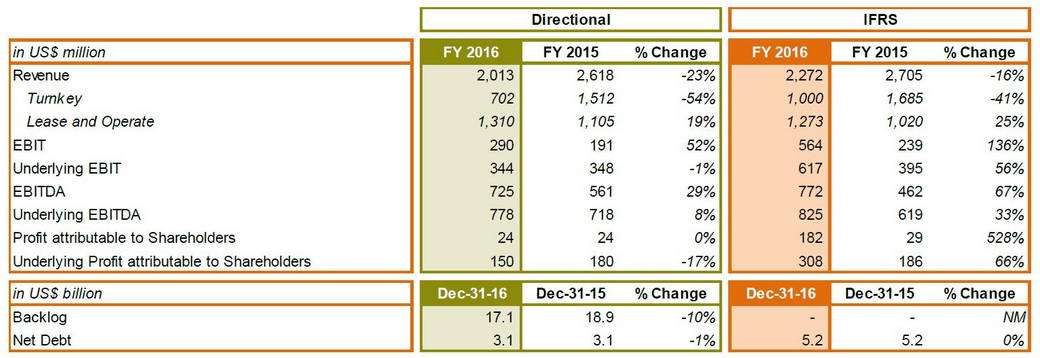

Underlying directional EBITDA for 2016 was 778 mill. $ at a directional revenue of 2,013 mill. $. Restructuring cost savings amounted to 260 mill. $, including foreign exchange rate impact. Cash return to shareholders totaled 211 mill. $ for the year in the form of dividend and share repurchases. Proportional net debt at year-end remained unchanged at 3.1 bn $, and cash/undrawn credit facilities of 1.9 bn $. For 2017 the company expects directional revenue around 1.7 bn $, and directional EBITDA around 750 mill. $.

After adjusting to the new market circumstances, the offshore industry shows early signs of stabilization but with a slow recovery. SBM Offshore says it has continued to transform itself to address this change, safeguarding experience to reinforce a strategic position underpinned by strong cash flow from the Lease & Operate portfolio. At the end of the year the Company was awarded contracts by ExxonMobil for a Floating Production, Storage and Offloading vessel (FPSO) for development and production in Guyana, subject to Final Investment Decision; the only major new FPSO-related contracts awarded in the industry as a whole in 2016.

During the year three FPSOs were delivered to clients, which were successfully integrated into the fleet. These new vessels further strengthened cash flow allowing the company to re-initiate the dividend and complete a significant 150 mill. € share repurchase program during 2016.

SBM clients remain cautious

To position the Company for the future and align its business with today’s reality in the oil services industry which is characterized by »lower for longer« activity, SBM Offshore initiated a strategic improvement program. This program leverages our experience and is structured around the pillars »Optimize«, »Transform« and »Innovate«. The importance of working closely with client teams to optimize developments combined with the ability to deliver projects on time and on budget has become crucial.

Management’s expectations for order intake in 2017 remain unchanged, aligned with an outlook for the industry where recovery is expected to be gradual as clients remain cautious regarding investment in their development programs. At the same time, productive client discussions continue to take place to make deep water projects competitive in today’s oil price environment. A positive medium to long-term outlook is maintained as deep water offshore is expected to remain an important element in the energy supply of the future.