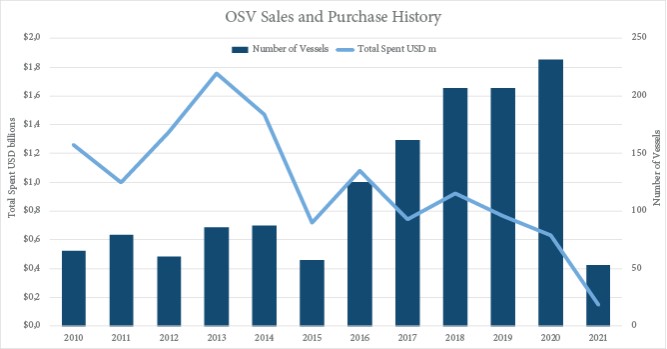

Looking at the sale and purchase history of the market of offshore support vessels (OSV), the picture is quite interesting. While during the first half of the past decade relatively few vessels were traded at increasing prices, 2015 saw a reversal of this trend. When the offshore crisis hit, a massive increase of vessel sales and continuously falli[ds_preview]ng prices characterized the years until 2020. In 2021, so far, vessel sales in terms of number of ships are on track to meet or surpass the 2015 numbers. At the same time, ship values have hit a 20 year low. The fleet age profile corresponds with this trend. Most ships are accumulated in the the 5–14 years range, while younger ships and newbuildings are a rare thing.

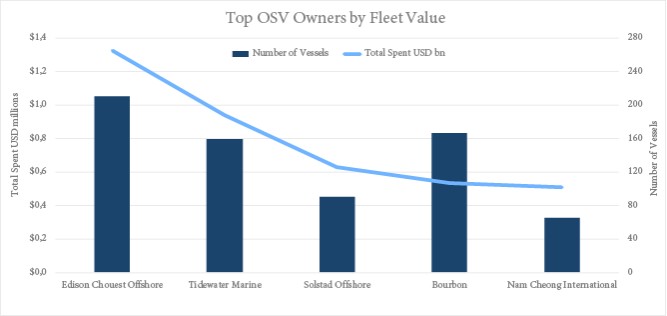

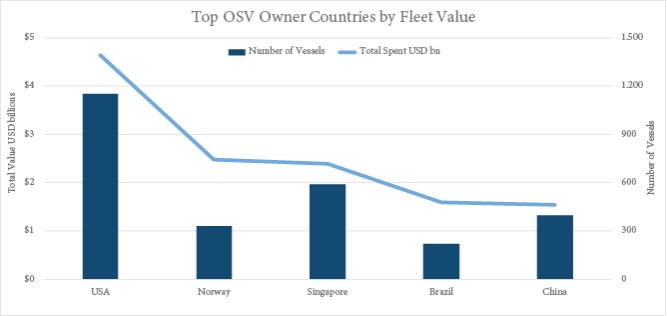

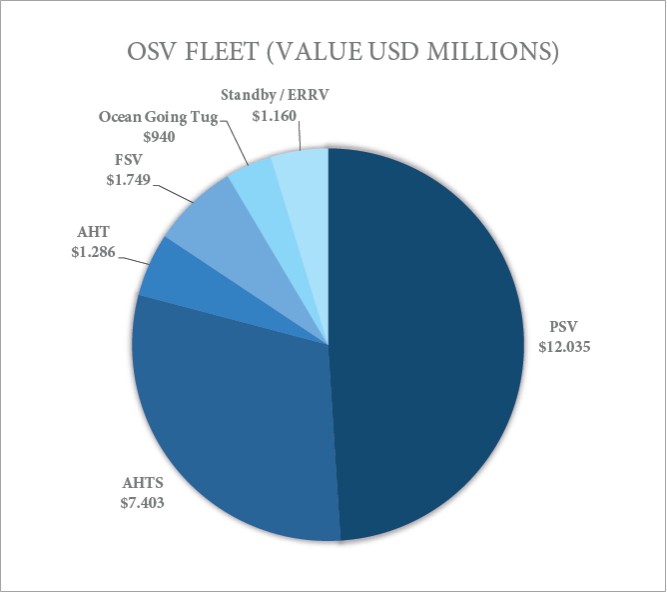

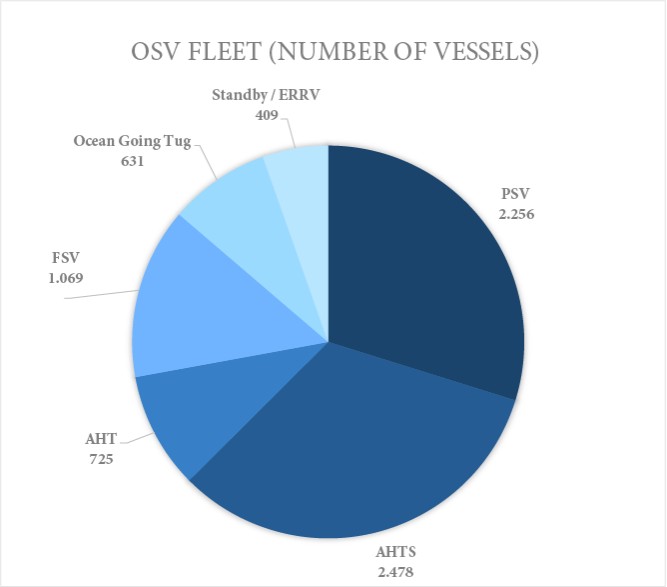

The OSV market is dominated by Platform Supply Vessels (PSV) and Anchor Handling Tug Suppliers (AHTS). In terms of fleet segment size they make up almost two thirds of the OSV fleet. In terms of fleet value, the PSV fleet accounts for almost half of the total OSV fleet value. The top owner countries are led by the USA, followed by Singapore and China in terms of fleet size. Regarding fleet values, Norway and Brazil make their way into the ranking on positions 2 and 4. Shipwoner Edison Chouest Offshore owns the largest and most valuable fleet, followed by Tidewater Marine, Solstad Offshore, Bourbon (second in terms of fleet size) and Nam Cheong International.