Due to the constant market pressure, most [ds_preview]ship management companies reduced vessels operating costs in recent years. But caution should be taken when interpreting the results over time, according to HANSAs latest OPEX study, which is presented today at the 20th »HANSA-Forum Shipping | Financing« in Hamburg.

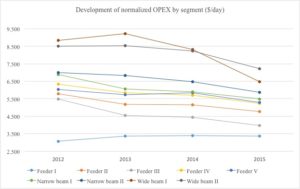

Ship manager had to adjust to market pressures and were forced to reduce their costs between 2012 and 2015. With the exception of Feeder Segment I (300 – 949 TEU, gearless), all analyzed segments showed a reduction of total normalized OPEX in US dollars – where shipyard costs are deducted. In some segments there can be seen significant savings, for example the class »wide beam I« (formerly »Post-Panamax I«, < 7,000 TEU): this segment saw a reduction of roughly one third. For smaller vessel types, it appears that a reduction of personnel expenses and a decline in insurance costs are the main leveling screws.

The reduction of operating costs was imperative for ship owners and managers in order to stay competitive in the harsh market environment – in particular as there are new stumbling blocks on the horizon. Some analysts argue that the shipping industry is facing a new rise in operating costs coming in the next years, especially due to regulatory measures like the ballast water convention entering into force as well as additional costs for reducing the carbon footprint of the industry. These are just examples for triggers of necessary investments in existing vessels.

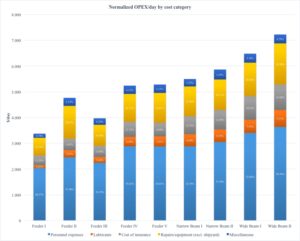

The HANSA OPEX study presented today reveals, that as the size of the ship increases, so does the contribution to the OPEX reduction from all other cost categories. In fact, lubricant savings and reductions in repair and equipment expenditures become particularly relevant for larger ships. A big share of cost reduction can be attributed to the cutting of personnel expenses, since it had the biggest saving potential, at least for the ships which were still sailing under a high cost flag.

In most cases, personnel expenditure reduction was a result of flag change. Caution should be taken when interpreting the results of OPEX over time. While dollar results decreased for most segments, Euro results partly witnessed an increase in costs. This is mainly due to the fact that the Euro was subject to heavy devaluation at the end of 2014 and the beginning of 2015.

Most of the tracked single shipping companies do their accounting in Euro. Because the majority of expenses have to be paid in dollars (which were much more expensive in 2015 than in 2014), their Euro costs increased in 2015. However, since the majority of expenses is paid in dollars (as well as the charter rates/cash flow), the development of the OPEX’s Euro value is less relevant for a comparison over time. Thus, we just focussed on the development of the daily US-dollar expenses for the longitudinal analysis.

Higher OPEX for geared vessels

Another finding is that geared vessels tend to have higher OPEX than their gearless sisters. This observation can mainly be traced back to higher expenditures on repairs and equipment and, to a minor degree, to more extensive spending on manning, insurances and lubricants. While a large share of the cost difference can be attributed to gear requirements, one should keep in mind that geared vessels often operate in areas where costs resulting from repairs, equipment and insurances are usually higher.

Interestingly for the Feeder Segments IV and V (2,000 – 2,999 TEU) this observation cannot be made on the basis of normalized OPEX. However, when incorporating shipyard costs, it becomes apparent that geared vessels of this size are more cost intensive to operate as well. Apart from Feeder Segment I (300 – 949 TEU, gearless), Feeder Segment V (2,000 – 2,999 TEU, gearless) and the size group Narrow Beam I (3,000 – 3.999 TEU), all other segments suggest a positive correlation between ship age and operational expenditures.

However, since the survey mainly consists of descriptive statistics, this correlation has not undergone a significance test. When comparing the different segments and their cost components in relative terms, it is interesting to note that the relative share of repairs and equipment as well as miscellaneous OPEX remain quite constant in between the segments. However, the share of personnel expenses is likely to decrease with ship size. On the other hand, bigger ships tend to pay more for their insurances in relative terms and the expenses for lubricants rise with engine size.