The chemical shipping market currently und[ds_preview]ergoes several consolidation steps. This might remain necessary, as the market faces tonnage overcapacity for a longer time.

Just to name a few examples: Stolt Nielsen, after taking over the chemical tanker operation of Jo Tankers, player recently reported a profit slump of 15%, newbuilding projects had to be scrubbed, alliances have been announced.

The biggest problem of the industry is the tonnage overcapacity. And this will most probably continue to burden the market. Shipping consultancy Drewry forecasts in a new report, freight rates on long-haul routes will continue to be challenged by surplus large vessels over the next two years, as vessel supply on major routes has already been in surplus with many newbuilding deliveries and swing tankers flooding the market.

Time charter rates weakened in 2016, especially for larger tankers, and freight rates on major long-haul routes dropped. Although the trade volume from the US to Europe and Northeast Asia surged in 2016, the appearance of speculative vessels brought rates down.

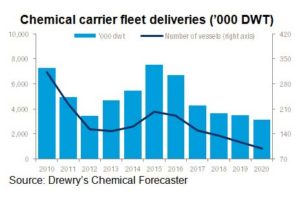

According to the report, the fleet will continue to expand because of the large number of orders placed in previous years, but growth will be subdued compared to 2015-16. While deliveries and ordering have reduced in 2016, there are still many ships scheduled to be delivered in the next five years because of heavy ordering during 2014 and 2015.

However, more demolitions are expected because of new regulations that will come into force in 2017. »Coupled with the implementation of the Ballast Water Treatment System (BWTS) in September 2017, the adoption of the global 0.5% sulphur cap may potentially accelerate the rate of vessel demolition towards the end of 2020. However, this is likely to have little impact on fleet supply, as most of the older ships are of less than 10,000 dwt, and thus, the capacity that can be scrapped will be a small percentage of the total fleet«, Drewry says.

However, more demolitions are expected because of new regulations that will come into force in 2017. »Coupled with the implementation of the Ballast Water Treatment System (BWTS) in September 2017, the adoption of the global 0.5% sulphur cap may potentially accelerate the rate of vessel demolition towards the end of 2020. However, this is likely to have little impact on fleet supply, as most of the older ships are of less than 10,000 dwt, and thus, the capacity that can be scrapped will be a small percentage of the total fleet«, Drewry says.

Time charter rates weakened further in the fourth quarter of 2016, more so for larger tankers. »We expect fleet oversupply to persist in 2017 and time charter rates for larger ships, especially MRs, to decline because of stiff competition. However, rates for vessels in the smaller categories are likely to remain stable in 2017,« commented Hu Qing, Drewry’s lead analyst for chemical shipping.

She adds, »The chemical fleet grew by 5.2% in 2016 and is expected to expand by 3.3% to the end of 2017, which will continue squeezing rates on major routes over the next two years. New orders and deliveries are also expected to decline further because of the depressed market and financial woes of shipyards.«