Global container freight rates experience further short-term growth. However, year-on-year, there is a big slump.

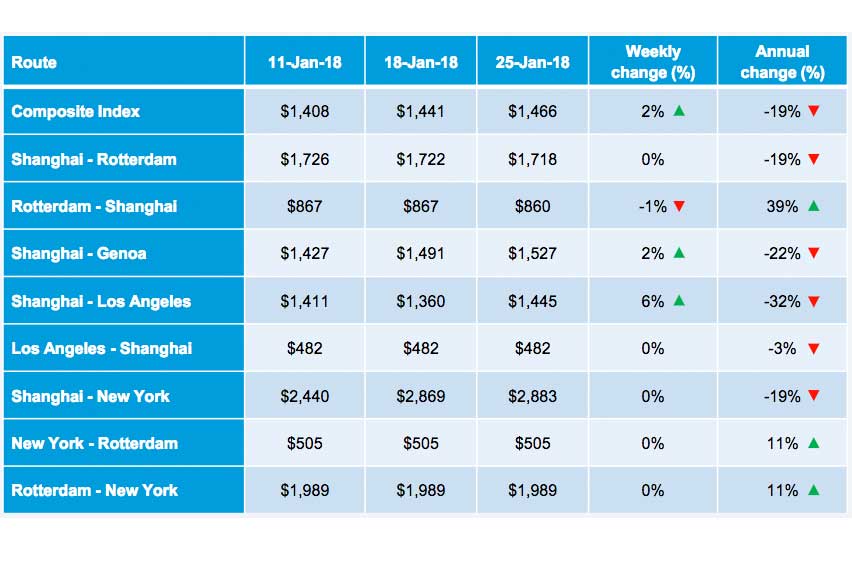

One the one hand, the World Container Index (WCI) assessed by shipping consultancy Drewry, a composite of container freight rates on eight major routes to/from the US[ds_preview], Europe and Asia, is up by 1.7% to 1465.72$/FEU this week.

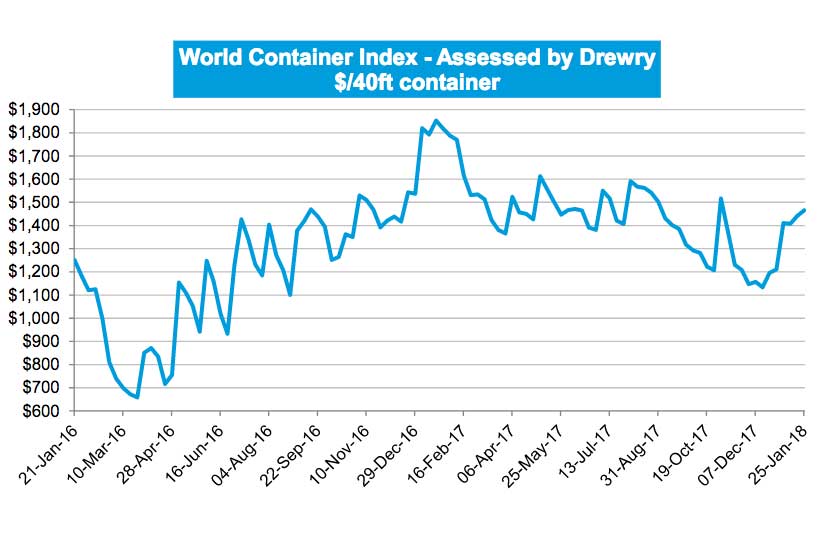

The two-year spot freight rate trend for the World Container Index:

One the other hand, a more long-term comparison show a very different result: The index is down by 19.4% from the same period of 2017. The average composite index of the WCI, assessed for year-to-date, is US 1,431$/FEU, which is 147$ lower than the five-year average of 1,578$.

The World Container Index, on Shanghai-New York, edged up by $14 per FEU to reach $2,883. »Tight space in the all-water services to the USEC helped the carriers to drive rates up on services to the West Coast«, Drewry states. As a result, the rates on Shanghai-Los Angeles gained $85 per FEU this week. Rates on the Asia-North Europe route were stable this week, while rates on Shanghai-Genoa gathered $36 to reach $1,527, for a 40ft box. »We expect rates to jack up on the back of the demand spike before the Chinese New Year holidays and the 1 February GRIs«, it is added.

Our latest freight rate assessments on eight major East-West trades