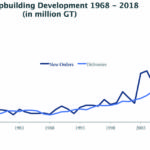

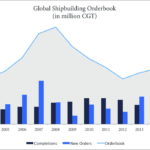

The demand situation in global shipbuilding remains tense. While the recovery in terms of new orders continues for the second year following the 30-year record low in 2016, the volume of newbuilding orders remains at a low level

Compared with the previous year, the total tonnage of newbuilding orders rose by more than 60% during the first three[ds_preview] quarters of 2018, however the number of orders received remains below global deliveries.

As a consequence the global order book continues to shrink, and the production capacities of many shipyards are underutilised. A clear change in trend is not yet visible. Despite a painful consolidation phase in the shipping industry and scrapping activities continuing at a high level, some overcapacities are expected to remain across the cargo shipping segments. The reason for the slow drop in overcapacities is the hesitant growth in the cargo sector. The British consultancy firm Drewry’s therefore had to correct its forecast for container demand over the next five years. Contrary to the previous expectation that supply and demand would gradually strike a balance by 2022, allowing the industry to find its equilibrium again after struggling for a long time, the dull prospects for the world economy amid growing international trade tensions have prompted the forecasters to modify their predictions. The current overcapacities are now expected to persist for several more years. Similarly, the International Monetary Fund has lowered its forecast of global economic growth to 3.7%, and of trade volume growth to 4.2 and 4.0%, respectively, for the years 2018 and 2019. Therefore the troubles for the shipyards are likely to persist.

On a more positive note, several international regulations particularly related to emission reduction are about to enter into force. To fulfil the new requirements, investments in better and cleaner technology are necessary. For newer tonnage this will trigger retrofits. However, for older tonnage this might not be an economically viable option. Most experts agree that the rule changes will call for early replacements. Therefore, a stimulus also for the newbuilding market can be expected.

Because of the sluggish situation in the cargo ship newbuilding market, some yards have begun offering their products at dumping prices to remain in the market. In some cases, the prices offered are known to be too low to even cover the expected material costs, a fact that will prevent a rapid return of a lasting market balance. At the end of September 2018 the Clarkson Research Newbuilding Price Index stood at 130 points (2008: 178 points), remaining at a low level for the 10th consecutive year. Protectionism and a distorted competitive environment due to government subsidies and bailouts have been on the rise in many shipbuilding countries. A level playing field for the global shipbuilding industry is thus a long way off.

Stricter environmental standards

Oceangoing ships transport substantially more cargo than land and air transport. In terms of transport capacity, they are by far the most energy-efficient means of transport. In spite of these facts the shipping industry has come under enormous pressure to reduce its environmental footprint in recent years: Conventional fuels cause significant pollution by emitting sulphur oxides, nitrous oxides and particulate matter. Furthermore, the introduction of invasive marine species into new sea regions, especially through ballast water carried on board or organisms growing on ship hulls, threatens the integrity of marine ecosystems. Uniform, compulsory international regulations aiming to make shipping safer, cleaner and more efficient are therefore of critical importance. The International Maritime Organization (IMO) is steadily working to refine its regulatory measures. In addition to establishing Emission Control Areas (ECAs) and passing the ballast water convention which took effect in September 2017, the IMO has defined global emission limits that will enter into force in the near future. The 2020 effective date for the new sulphur emission limits in international waters is rapidly drawing nearer. The climate protection roadmap passed by the IMO in April 2018 aims to reduce greenhouse gas emissions from shipping by 50% by the year 2050 compared to 2008 levels, and to achieve entirely climate-neutral ship operations by the end of the century at the latest.

The stricter environmental regulations are lending new impetus to the market. By developing innovative technologies and operational strategies, the German maritime industry is making a significant contribution to a more eco-friendly shipping industry. Many of these young technologies are helping reduce the industry’s ecological footprint.

Green technology and retrofits from Germany

Apart from developing alternative fuels and propulsion systems, the industry is working on propulsion optimisation measures and innovative approaches to ship design. Other environmental technologies include scrubbers, ballast water treatment systems and alternative hull coatings as well as software and hardware enabling more efficient ship operation. In 2018 new orders in Germany mainly included cruise ships, ferries and mega yachts. In addition, offshore supply vessels, specialised government craft, research vessels and various types of naval vessels supplement the orderbook of German shipbuilders. All these niche markets outside the standard cargo ship types require individual solution concepts accommodating unique and complex operational needs that must often be implemented in one-off projects. One of the German maritime industry’s key strengths is the development of innovative green technologies. For example, the world’s first LNG-powered cruise ship was delivered in Germany in 2018. Additional cruise ships with LNG-based propulsion systems are on order at German shipyards. Similarly, the ferries ordered in 2018 will be equipped with eco-friendly LNG or hybrid propulsion systems. Apart from yards building new ships that set new ecological standards, the ship conversion and retrofitting business should not be underestimated. From exhaust gas cleaning equipment to ballast water system installations, shipowners depend on state-of-the-art repair and conversion yards along with a reliable supplier network to ready their fleets for the future. Customers not only look at the mere costs involved in these retrofits but also consider factors such as compelling servicing and maintenance concepts and the quality of after-sales services being offered.

It takes a strong industry to meet both, the tougher technical requirements and the high expectations of the general public. A healthy market and fair market conditions are key enablers.