The Norwegian shipowner community shares a slightly more positive outlook than in the last years. However, there are concerns about access to capital and the national tax regime

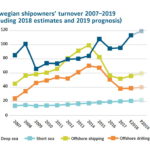

In the 2019 member survey, the association sees the change in outlook identified last year being followed up by cautious[ds_preview] optimism. Since the financial crisis hit the industry in 2008, the transport segments have gradually increased their turnover, which is now substantially higher than before the financial crisis. The offshore segments, facing very demanding times since the price of oil fell in 2014, and seeing their turnover halved from 2014 to 2017, have experienced a slight increase in turnover over the past two years. Turnover in these segments has now stabilised at a low and unsustainable level.

Shipowners’ total turnover increased by 11%, from 206 bn NOK in 2017 to 229 bn NOK in 2018. The transport segments, comprising the deep-sea and short sea shipping companies, have gradually increased their turnover since the financial crisis hit the industry in 2008. These segments now account for 60% of total turnover among shipping companies. Since the fall in oil prices in 2014, the transport segments have strengthened their relative position compared to the offshore segments.

It appears that 2019 will be a year with continued marginal growth. All segments expect increased revenue in 2019. If this prediction proves accurate, shipowners’ total revenues will end at about 240 bn NOK in 2019, up almost 5% from last year. Over the past two years, shipowners have adopted a more positive outlook regarding profitability. More than half now expect operating profits to improve in 2019 compared to 2018. By comparison, half of the shipowners expected weaker profitability in 2017. One in five shipowners expect weaker profitability in 2019 compared with 2018. One year ago, one out of four shipowners had the same outlook.

Less layups

The biggest change in anticipated results is found among offshore shipping companies. For these companies, the proportion anticipating increased profitability has risen from 35% in 2018 to 47% in 2019. The proportion expecting weaker profitability has decreased from 32% to 25%. »However, an improvement in operating profit does not imply that these shipowners have achieved sustainable profitability. Low rates and limited activity mean that offshore shipping companies are still facing demanding times«, the report states.

Last year’s report brought the news that peak layup had been reached. In February 2017, 183 vessels and rigs were in layup. The corresponding figure for February 2018 was 162. As of February 2019, there are 112 vessels and 20 rigs in layup. This is a reduction by 25 ships and five rigs.

Forecasts for 2019 indicate that the number of ships and rigs in layup is expected to fall to 93, a reduction by 34 ships and five rigs. Of these, offshore shipping companies control 33 vessels and deep sea shipowners one ship. This reduction is due to a combination of increased activity, ship recycling, and sale of vessels.

As a result of what is described as »proactive maritime policies«, such as the relaxing of trade area limitations and expansion of the tax refund scheme for seafarers, 96 vessels have flagged in to the Norwegian register over the past three years. Now 24 shipowners state that they are considering flagging ships in to NOR or NIS. The total potential is 78 vessels, divided among 44 deep sea vessels, 22 offshore vessels and twelve short sea vessels.

Capital concerns

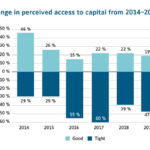

However, there are some less positive developments as well. According to the report, shipowners’ access to capital was gradually weakened from 2014 to 2017, while in 2018 there was an improvement in the capital market. »In 2019, we once again see a worsening situation, with shipowners now considering access to capital as tighter,« it is said. The share deeming access to capital as good has decreased from 22% in 2018 to 19% in 2019. Of those considering access to capital as tight, the share has increased from 39% in 2018 to 47% in 2019.

There are large variations between segments. Offshore shipping and offshore drilling companies appear to be facing the most demanding situation, with 64% and 71%, respectively, considering access to capital as tight. One reason for this may be that the offshore industry will continue to be characterised by further restructuring and refinancing.

This is a significant deterioration for these groups since 2018, when about half thought the same. None of the offshore drilling companies believe that access to capital is good. Among deep sea and short sea shipowners, about 30% consider access to capital to be good, while there is wide variation among short sea shipping companies. Short sea shipping companies are most optimistic about the development of capital access for 2019, with one-third of these expecting better access to capital. »However, this must be seen in light of the fact that many of these shipowners experienced an unexpected worsening in the capital market during 2018«, the report says. Among the deep sea shipping companies, two out of three expect unchanged access to capital in 2019.

50 % of shipowners will order

In this year’s survey, half of shipowners state that they will order new ships or rigs over the next five years. The shipowners consider to build a total of 137 ships and five rigs, mostly in the transport segments. The short sea shipping segment expresses a need and a strong desire for fleet renewal. The average age of vessels among members of the Norwegian Shipowners’ Association in short sea shipping is 22 years. Eight out of ten short sea shipowners are considering to order new ships over the next five years. This means that the potential for renewal in the short sea fleet is great, and that the average age of short sea vessels will be reduced. The corresponding figure is four out of ten for offshore shipping companies, and half of all deep sea shipowners. Almost four out of ten offshore drilling companies are considering building rigs, up from around one in ten in 2018. Deep sea shipowners consider to order 76 ships, followed by offshore shipping companies with 33 vessels, and short sea shipping companies with 28 vessels.

Demands on tax and policies

The demands made on politicians include to strengthen the tax refund and net wage schemes for Norwegian seafarers on Norwegian registered ships, to ensure attractive and competitive export financing schemes through GIEK and Export Finance Norway and to remove the wealth tax on working capital. »A competitive Norwegian tonnage tax regime is essential for maintaining Norway’s attractiveness as a host country for shipping companies and other maritime activities«, the association emphasizes. About eight out of ten shipping companies state that a weakening of the Norwegian tonnage tax regime will affect their business very negatively or negatively. Last year, six out of ten shipping companies responded that it was probable or very likely that they would move their business out of Norway if the Norwegian tonnage tax regime was significantly weakened. It was therefore well received when in 2018 the tonnage tax scheme was extended for another ten years.

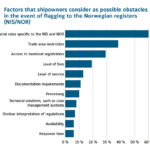

Shipowners consider specific Norwegian rules and trade area restrictions as the two most important factors that prevent flagging into the Norwegian register. 60 and 38% of shipowners, respectively, state these factors as barriers. Just under 30% of the shipping companies believe that the lack of access to bareboat registration is the biggest barrier.