The cruise industry had to navigate around several cliffs in the last two years, and to some extent it still does. But there are positive developments and various movements in the fleet and in the newbuilding market. Are we on our way out of the pandemic? By Arnulf Hader[ds_preview]

Once more, analysing passenger numbers is not very useful. Cruise industry association CLIA reported 5.8 mill. passengers in 2021 compared to an annual capacity of more than 30 mill. The fleet development, however, has not stopped. 2021 was the year when new ships were handed over to the owners which had been postponed from 2020, while other deliveries were postponed from 2021 to 2022.

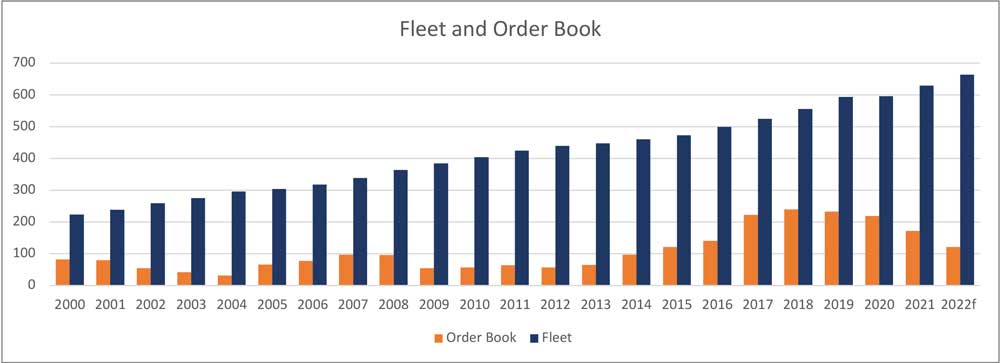

This is why an updated list of 2021 deliveries follows here. The exact date of handover is not very relevant because many ships went into lay-up before cruises were allowed again in the pandemic. The total tonnage and capacity of these 23 vessels is smaller than the totals to come this year because of the larger share of small expedition vessels. This year some more big vessels will result in a total of 44.000 beds. In case no new orders will be added – a scenario which is quite realistic – 122,000 beds in 5.3 mill. GT of new tonnage will still be in the order books by the end of December. This allows to complete further 39,000 beds in 2023 and 33,000 beds in 2024. The order books of the Royal Caribbean Group extend until 2026 and these of MSC and NCL into 2027.

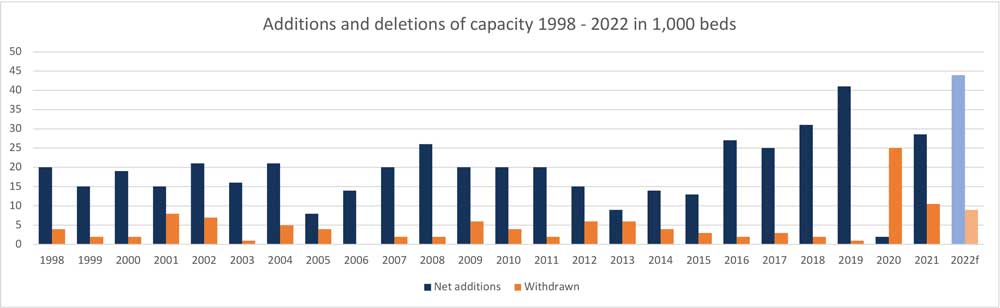

The order book showed very high figures when Covid led to a global standstill of cruise shipping two years ago. Within a few months, ship owners and yards had come to agreements to delay deliveries by several months or years. As expected, there is a lack of new orders now for two years with-out new contracts and projects – except for two smaller ones. Today, the three leading cruise ship builders are still busy because of the extraordinary order book from two years ago, which is now nearing a normal fleet to order book ratio. The following graphs show – like the others – the figures for the end of 2021 and the forecast for the end of 2022. They show also that 2020 is the only year in a long development when the fleet capacity stagnated because of un-usual high sales for scrap. The high column in 2020 underlines the high scrap sales.

2022 fleet forecast

The forecast takes into account the de-livery of 20 new ships including those which had been planned for delivery in 2021 but could not be completed in time. The largest ship by number of guests could be the »Global Dream« with 9,500 beds in 2,500 cabins. The delivery depends on a new owner – who is still to be found – to buy the ship as it is in the in-solvent shipyard at the Wismar site of MV Werften. Another new ship above 200,000 GT is the »MSC World Europa«, the first of four under construction at Chantiers de l’Atlantique. The »MSC Sea-scape«, to be overtaken a few weeks later from Fincantieri, is not much smaller. The Carnival Group expects four ships, among them are two of the LNG ships of the Meyer Werft Group with more than 180,000 GT and 5,200 lower beds for the Carnival Cruise Line and the P&O brand.

Princess Cruises gets the last of six 3,660 bed »Princesses« and Seabourn gets a high-end luxury vessel with only 264 beds. Meyer Werft of Papenburg starts a new series for Disney Cruises with the 144,000 GT »Disney Wish«. The 3,258 bed »Celebrity Beyond« will be the third of five in the current series for Celebrity Cruises, the premium brand in the Royal Caribbean Group. »Norwegian Prima« with her 3,250 beds is the first of six sisters for NCL, who decided some years ago not to join the run for the largest capacities afloat. The 108,000 GT / 2,770 bed »Resilient Lady« will already be the third ship for the new entrant Virgin Voyages which had not carried many passengers up to now, because it had planned to enter the mar-ket when the pandemic broke out. The completion of the luxury vessel »Evrima« was delayed several times. Viking Ocean Cruises will add two more »planets« to a long series and the second of two expedition ships. The remaining four expedition ships for other operators are below 10,000 GT and belong to running series.

Scrapping in 2022

The capacity forecast also includes the expectation that a handful of vessels will leave the active fleet permanently. Among them could be two further Carnival ships of the »Fantasy« class. Four of this class were already sold in 2020 and two more were sold in early 2022. Since the first four arrived at scrapyards mean-while, another fate would be surprising in the actual cases. Background to this assumption is that the first three went directly to a Turkish beach while the fourth was acquired by the Chinese river cruise operator Century Cruises, but finally this Century Harmony« arrived in Pakistan for scrapping early 2022.

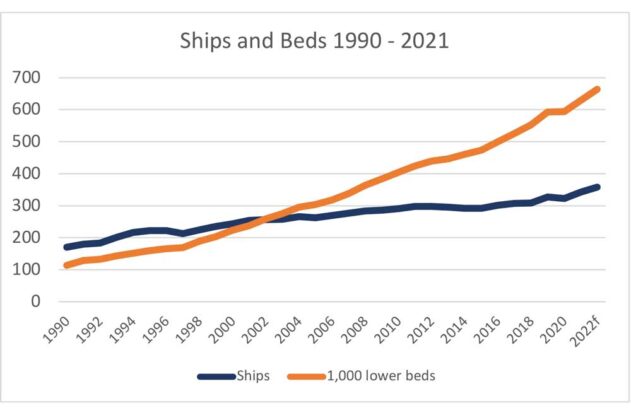

Some smaller ships which are waiting for new charters for two years now may also reach their end of life. The five charter-free vessels of Seajets allow some speculation too. The deletions in 2022 could sum up to 300,000 GT and 10,000 beds. Under these assumptions, the fleet reaches 358 ships with 26. mill. GT and 664,500 beds at the end of 2022. At the beginning of this year, the count was 343 ships with 25.25 mill. GT and 629,000 beds. The rise of average sizes and capacity per ship is slowing down. There is still a number of big ships with more than 100,000 or 200,000 GT in the order books but the number of small luxury and expedition vessels is augmenting. The over-tourism in port cities and the pandemic are good reasons for more smaller ships when new ships are ordered again.

The Genting Group

The most interesting single topic at this time is the future of the Genting Group with its ship operators and shipyards. Within a few weeks of January, major companies in the group were declared bankrupt. Discussions arose around the completion of the »Global Dream« in North-Eastern Germany. This 2,500-cabin giant is 75 % completed in the covered dock in Wismar. When the government of the State of Mecklenburg-Vorpommern asked to contribute their share to the provision of the next loans for completion of the ship for the brand Dream Cruises, the Genting Group said they were not able to do so. Meanwhile, leaders of the Genting Group stepped down, the luxury brand Crystal Cruises stopped all activities and the ships are arrested in the Bahamas be-cause of unpaid fuel bills.

The three ships are for sale, including the new »Crystal Endeavour«. The booking engine of Dream Cruises, with ships sailing from Hong Kong, Singapore and Taiwan, went offline. The river ships in Germany are still in winter lay-up. Manfredi Lefebre d’Ovidio, who has sold his Silversea Cruises to the Royal Caribbean Group a few years ago, has shown interest in ac-quiring the sea and river cruise ships of the Crystal fleet for his Heritage Group. Following the dissolution of Genting, the management of the fleet is actually done by V.Ships and River Advice.

The fate of the German shipyards group MV Werften with sites in Wis-mar, Warnemünde and Stralsund and their remaining 1,900 employees is in the hands of the insolvency administrator. They stopped working until new owners are found. This is the current situation in February 2022. There is hardly any chance that the group will survive as major builder of cruise ships:

- Lloyd Werft of Bremerhaven is a traditional ship repair yard which is also fitting out mega yachts. A yacht com-pany in the United Arab Emirates, the neighbouring ship repairer and builder Rönner and Kurt Zech of Bremen are interested in buying the renowned facilities. A sales contract could be finalised in the near future.

- The Stralsund shipyard with a shipbuilding hall and syncrolift ran short of work following last year’s delivery. The construction of sister ships is not possible anymore since most of the 650 employees lost their jobs with the completion of the »Crystal Endeavour«. Now, the city has good chances to buy the facilities close to the city centre. It is intended to offer the facilities to different companies including ship builders.

- The Rostock-Warnemünde based shipyard is specialized on steel work and has already put together some sections for the sister vessel of the »Global Dream«. Chances are low that a new owner for these parts will be found quickly and new jobs for the yard are sought. One possibility is the return to the production of offshore platforms for the wind parks in the Baltic and North Sea. Such platforms were already constructed there a few years ago.

- Several cruise operators are said to be interested in the » Global Dream«. It remains most interesting to see what this means for the ship and the Wismar shipyard. It is being speculated that the cash-rich MSC Group could acquire it for the entry into the Chinese cruise market.

Operator news

Having lost billions of dollars in the pandemic, the big ship operators have survived and hope to return to normal in 2023. The Carnival Group is expecting the return to a positive cashflow in the second quarter 2022 already. During the fourth quarter of 2021 the average turnover per passenger was 4% above 2019 due to higher onboard sales in spite of a low use of capacity of only 58 %. End of 2021 Aida Cruises has taken over the second LNG ship from Meyer Werft, the 5,200 bed »AIDAcosma«. This expansion of capacity allowed the sale of the »AIDAmira«, the oldest vessel in the fleet, following the sale of the »AIDAcara« to a Russian company. In the fleet of Ambassador Cruises »AIDAmi-ra« will be renamed to »Ambition«. The new British brand is overwhelmed by the number of bookings for the 1,400 bed »Ambience« and is even looking for a third ship. Parallel to the crisis of cruise shipping, container ship owners are earning the highest charter and freight rates ever. Mediterranean Shipping Company (MSC), being present in the container and cruise business at the same time, is interested in buying the majority of ITA Airways, the successor of Alitalia, together with the airline partner Lufthansa. ITA is planned to supplement both companies by carrying cargo and passengers to the cruise ships.

By the introduction of the third sailing vessel »Seacloud Spirit« the Hamburg based company SeaCloud Cruises seems to have grown into an interesting size for investors. Thus, it was decided to accept a takeover offer from The Yacht Portfolio. This group will also introduce its long-delayed first ship »Evrima« for the brand Ritz-Carlton Yacht Collection soon.

Latest developments

By December 2021 a total of 68 ships have been reactivated, among them 20 of Royal Caribbean Cruises, 17 of Carnival Cruise Lines and 13 of MSC Cruises. Australia is the last major market of the world without a plan to allow sea travel. The validity of the March 2020 ban is extended by two months. Carnival and P&O Australia pause until April 2022. Due to the growing number of trips, more passengers are being tested positive, but the huge number of empty cabins allows an effective isolation on board. Since all guests above twelve years should be vaccinated, the infections are vaccination breakthroughs which remain without or only with minor symptoms. According to CLIA, among 600,000 passengers only 1,300 fell ill and one died.

Over the past few weeks, the Omikron variant spread so quickly that several ports denied ship calls, leading to changes in the routes of the ships. The U.S. CDC advises against cruises once more. The government of the Bahamas doesn’t let the passengers of an MSC ship disembark to the MSC private island. In early January, the CLIA reported 75 % of its capacity in service and the aim to reach nearly 100 % in August, but soon the Omikron variant spread over the world. NCL canceled the trips on eight ships until March or April. In Brazil, the government urged operators to stop their current trips.

In February, European countries started to reduce their pre-cautions because the symptoms of the variant are only light and fewer people are hospitalized. NCL dropped their face mask requirements for sailings out of the USA from March 1. Cruises operate with 100 % vaccination of crew and guests of age five and over. A booster vaccination is required by TUI Cruises and Hapag-Lloyd since 23 February, others followed that example. Only the Australian Minister for Health extends the pandemic emergency measures until 17 April, thus extending the ban on cruises beyond two years. P&O Cruises cancels the New Zealand season. Generally, the optimism in the travel branch returns and bookings for cruises are rising again. Costa Cruises announced that by the next summer season the entire fleet will have restarted.

All four new big ships »Costa Toscana«, »Costa Smeralda«, »Costa Firenze« and »Costa Venezia« will be deployed in the Mediterranean Sea, the plans for the Chinese market being cancelled. The Royal Caribbean Group is expecting 100 % occupancy this summer in the Alaska market with more ships deployed in the region than ever. The future of cruise shipping looked bright the day before 24 February when Putin’s troops invaded Ukraine. Ships in the Black Sea and Baltic were rerouted.