For many shipping companies, bonds are fea[ds_preview]sable option to secure financial stability. However, maritime consultancy Drewry now issued some serious doubts.

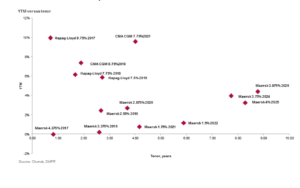

In the current interest rate environment, Drewry favours bond issues that lie higher on the risk spectrum with a short duration. In a recently launched report, both CMA CGM and Hapag Lloyd are named as examples, whose bonds »satisfy our bond picking criteria and have notes outstanding in the high-yield segment with low duration risk in many instances«.

However, Drewry adds, the notes on many occasions trade above par and the analysts do not believe the risk return profile is attractive based on the credit outlook for the issuers. »We believe the rally since the third quarter of 2016 is stretched and recovery is largely priced in. Therefore we see downside risk for bonds from the current levels as credit metrics are about to worsen in full-year results and the probability of a rating downgrade is significant as highlighted by the rating agencies«, it said.

The report came along with the launching of a new credit research service, which started with an analysis of the listed bonds of the three major container shipping companies, A.P. Moller Maersk, CMA CGM and Hapag Lloyd AG. In the future, the service offering is supposed to be expanded to cover other maritime sectors including port operators, dry bulk, tanker and gas shipping.