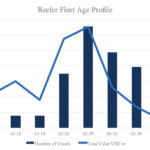

The fleet age profile shows that the majority of conventional reefer vessels is at least 20 years old. 105 ships[ds_preview] are between 20 and 24 years old, while 25-29 makes the largest age segment with 196 ships. 146 ships are 30-34 years old, 118 between 35 and 39. At 68 units, 40-44 years is still the fifth largest age segment. Currently, VesselsValue counts only three reefer vessels on order. Comparing the age segments, the 0-19 years segments (especially 0-4, 927,189 cft) may consist only of a few ships but are the most valuable.

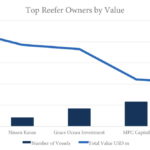

By value, Japan is by far the top owning country (43 ships, 14,670,460 cft, 520.5mill.$) followed by Russia (135 ships, 28,747,722 cft, 270mill. $), Netherlands, Hong Kong and China (81 ships, 182.4mi. $). Top reefer owners by value are Seatrade (31 ships, 12,438,285 cft, 226.7mill. $) Nissen Kaiun (5 ships, 3,518,158 cft, 192.6mill. $) Grace Ocean Investment (10 ships, 6,166,568 cft, 182.5mill. $), MPC Capital and Star Reefers.

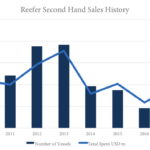

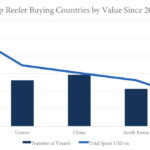

Second hand reefer sales have slowed down after 2012/2013. Top reefer buying countries in the past 10 years were Russia (70 ships, 22,071,247 cft, 70.3mill.$), Greece (39 ships, 16,246,248 cft, 172.8mill. $), China (44 vessels, 14,279,005 cft, 150.6mill. $), South Korea and the UK. The most active buyers were Baltic Reefer Service (18 ships, 7,668,995 cft, 77.2mill. $), Baltic Reefers (16 ships, 8,575,671 cft, 76.1mill. $), Star Reefers (4 units, 2,366,449 cft, 63.1mill. $), Santoku Senpaku (5 ships, 2,384,298 cft, 58mill. $) and Lavinia Corp. (12 ships, 5,092,772 cft, 52.9mill. $).